As 2026 approaches, HR departments across the U.S. face significant regulatory updates. From payroll and benefits changes to DEI requirements and workplace safety enforcement, staying ahead is critical. This blog is a practical, action-oriented guide designed to help HR teams prepare now.

Why HR Compliance is Shifting in 2026

The upcoming federal changes are driven by:

- Legislative updates – Payroll thresholds, tax credits, and benefit limits are being revised.

- Executive orders – Notably, Executive Order 14173, which impacts DEI requirements for federal contractors.

- Regulatory focus – OSHA, EEOC, and other agencies are updating enforcement priorities and monitoring practices.

These updates will affect payroll, benefits administration, diversity programs, and safety compliance, making proactive planning essential.

Key Compliance Areas HR Should Address

1. Payroll & Tax Reporting Changes

- 1099 Reporting: The 1099‑NEC / 1099-MISC threshold rises from $600 to $2,000 annually.

- FSA Contributions: Dependent Care FSA limits increase (e.g., from $5,000 to $7,500).

- Tax Credits: Expanded paid family leave and childcare tax credits affect HR reporting and payroll processes.

Action Steps:

- Update HRIS and payroll systems before Q1 2026.

- Coordinate with finance to ensure proper reporting.

2. DEI / Affirmative Action Shifts

- Executive Order 14173 limits certain DEI obligations for federal contractors.

- OFCCP restructuring may alter enforcement and auditing responsibilities.

- EEOC monitoring is increasing, especially in compliance with affirmative action and equal pay programs.

Action Steps:

- Audit DEI and affirmative action policies.

- Update contractor agreements to align with new requirements.

- Train managers and HR staff on revised practices.

3. Workplace Safety & OSHA Priorities

- OSHA is emphasizing heat illness prevention, indoor air quality, and recordkeeping transparency.

- Non-compliance may result in increased fines or inspections.

Action Steps:

- Conduct workplace safety risk assessments.

- Update safety training and incident tracking systems.

- Implement internal audits to verify OSHA compliance.

4. EEOC Enforcement & Anti-Discrimination

- EEOC is strengthening monitoring of workplace discrimination cases.

- Equal Pay Act, ADA, and Title VII compliance remain critical.

- Employers should track investigations, conciliation agreements, and internal resolution metrics.

Action Steps:

- Review EEO policies and complaint procedures.

- Train HR staff on new EEOC guidelines.

- Ensure reporting systems track compliance metrics effectively.

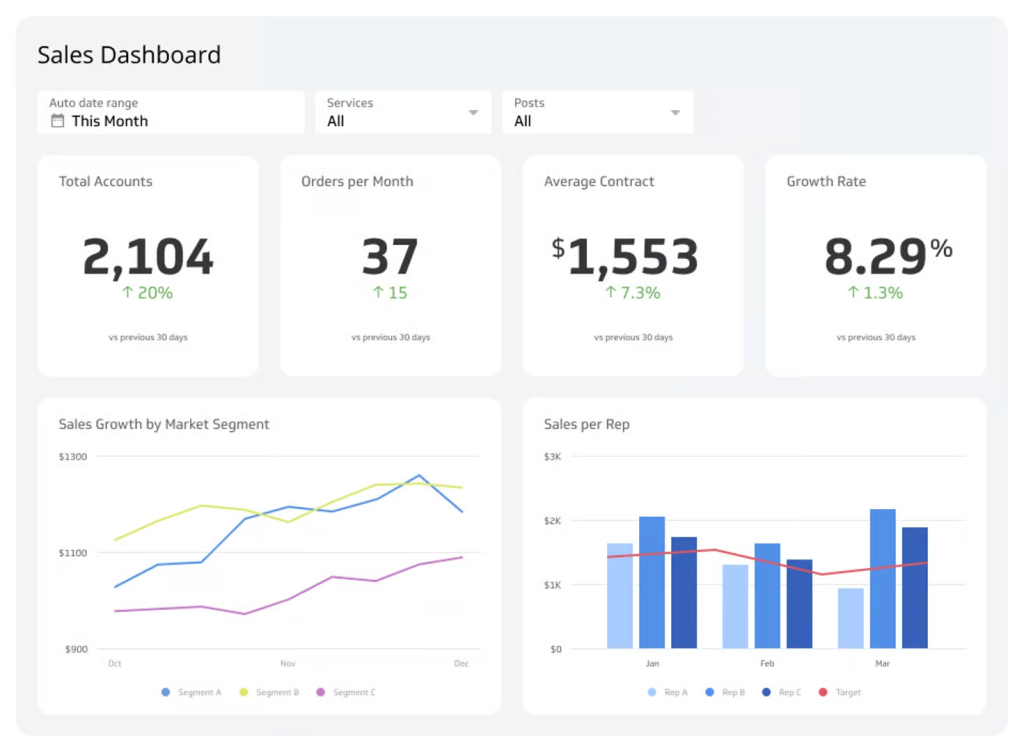

2026 Compliance Checklist for HR

Here’s a simplified checklist replacing the roadmap chart:

- Q4 2025

- Audit DEI and affirmative action policies.

- Coordinate payroll and benefits system updates.

- Conduct OSHA risk assessments.

- Audit DEI and affirmative action policies.

- Q1 2026

- Implement revised DEI and contractor compliance strategies.

- Launch EEOC and discrimination compliance training.

- Update safety protocols and reporting procedures.

- Implement revised DEI and contractor compliance strategies.

Metrics to Monitor

- Number of EEOC complaints or investigations filed.

- Percent of conciliation agreements with follow-up documented.

- DEI policy changes implemented.

- OSHA incident rate and heat illness prevention audit scores.

- Payroll and benefits system updates completed.

Why HR Should Act Now

- System updates take time – HRIS, payroll, and benefits platforms need configuration.

- Policies require legal review – DEI, contractor, and safety protocols must be vetted.

- Training & communication – Updated policies must be understood by staff and management.

- Risk mitigation – Early action reduces exposure to EEOC complaints, OSHA fines, or contract violations.

Proactive planning also positions HR as a strategic partner, not just a compliance function.

Useful Government Resources

HR leaders should monitor these official sites:

- EEOC Strategic Plan 2022–2026 – outlines enforcement priorities and strategic objectives.

https://www.eeoc.gov/eeoc-strategic-plan-2022-2026 - EEOC FY 2026 Budget Justification – provides insights into funding and enforcement focus.

https://www.eeoc.gov/fiscal-year-2026-congressional-budget-justification - Department of Labor FY 2026 Budget – details resources for worker protection and program updates.

https://www.dol.gov/sites/dolgov/files/general/budget/2026/FY2026BIB.pdf

Final Thoughts

2026 marks a pivotal year for HR compliance. With significant changes in tax reporting, benefits, DEI programs, and safety enforcement, staying ahead of deadlines is critical. Use this checklist and bullet-point roadmap to audit policies, update systems, train staff, and monitor key metrics.

By acting now, HR teams reduce risk and turn compliance into a strategic advantage, ensuring smooth operations and regulatory adherence throughout 2026 and beyond.